The 3.30 is not a strategy but its a very powerful setup to make a good profit in stock market. in this blog you will learn how to use this power full 3.30 formula in your trading. so just follow the below steps and enjoy

Step-1: Open Bank Nifty or Nifty 50 chart

Step-2: Time frame must be 5 minute

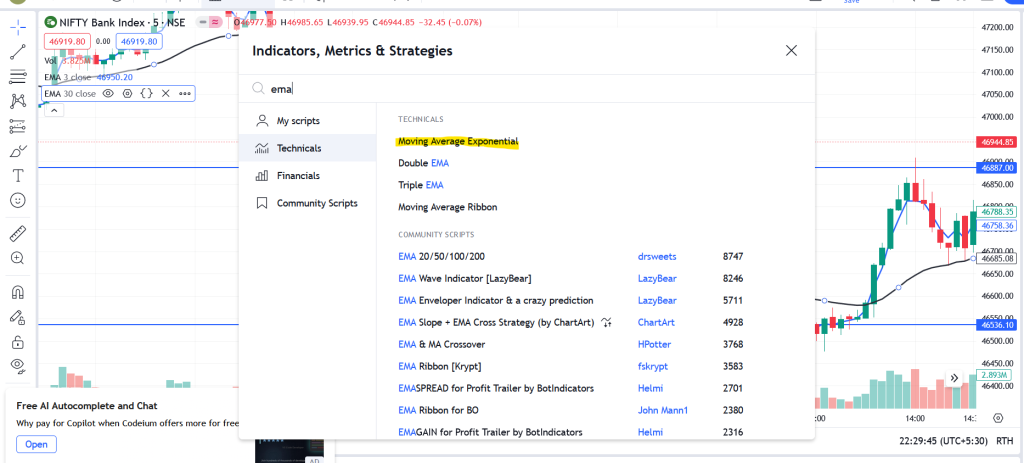

Step-3: Add Indicator EMA (Exponential Moving Average ) two times Shown in below picture

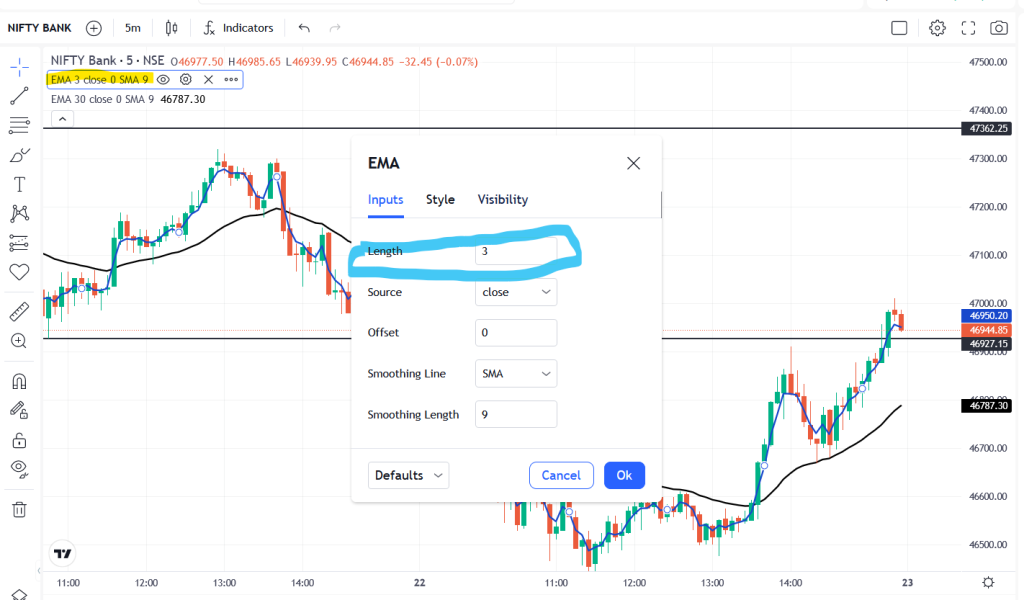

Step-3: Now to setup first indicator as shown in picture Set

On Inputs- set Length 3 and Color is BLUE shown as picture and click ok

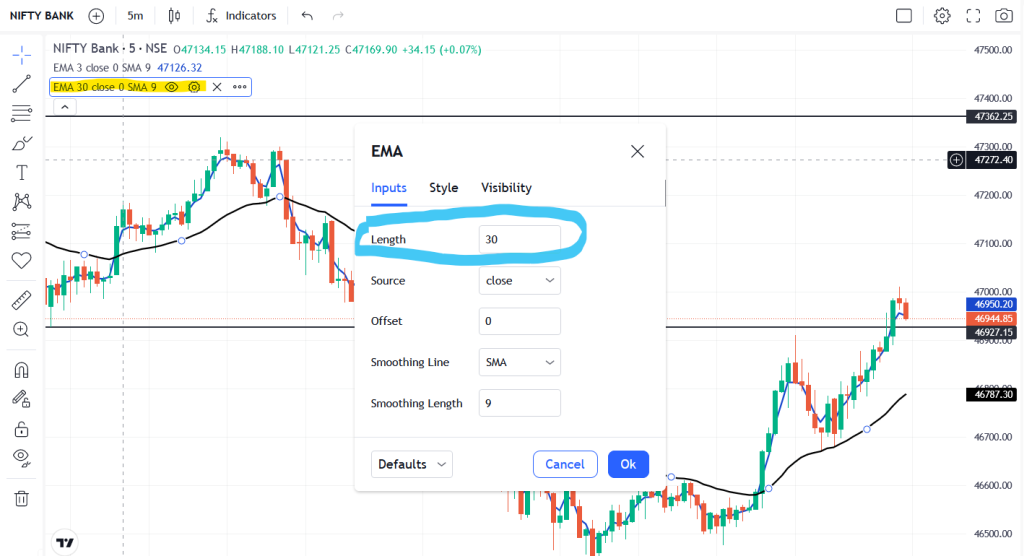

Step-4: Setup second indicator shown as picture

On Inputs- set Length 30 and color is BLACK shown as picture and click ok

That is it now your screen look like this

Now i am telling you how you will took trades and what will be the SL and Target in 3.30 strategy.

Rule-1: Whenever blue line cross the black line from the BOTTOM then we will create entry at CALL SIDE

Rule-2: Whenever blue line cross the black line from the TOP then we will create entry at PUT SIDE

For SL Swing low or last candle’s high and target is up to you

Note: We are not enforced you to take trade directly on behalf this first take some paper trade and then try it